Understanding the Basic Earning Power (BEP) Ratio

The Basic Earning Power (BEP) ratio is a crucial financial metric that reveals a company's operational efficiency. Unlike many other ratios, the BEP ignores the effects of financing decisions (like debt and interest payments) and taxes, providing a pure measure of how effectively a company uses its assets to generate earnings before interest and taxes (EBIT). This makes it particularly useful for comparing companies with different capital structures or operating in different industries. A higher BEP signifies superior asset utilization and stronger profitability. But remember, context is key!

Calculating the BEP Ratio: A Step-by-Step Guide

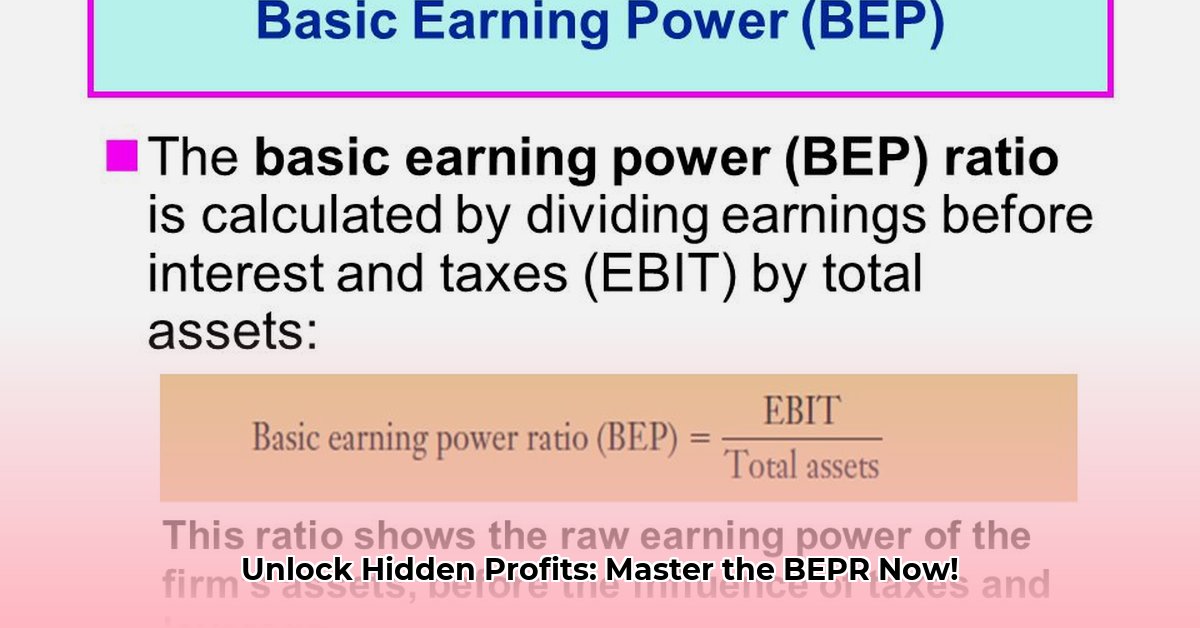

Calculating the BEP is straightforward:

(Earnings Before Interest and Taxes (EBIT) / Total Assets) * 100

- EBIT: This represents a company's profit before deducting interest expense and income taxes. It reflects the company's core operating performance.

- Total Assets: This encompasses all assets owned by the company, including tangible assets (like property, plant, and equipment) and intangible assets (like patents and goodwill).

Let's illustrate. If a company reports EBIT of $500,000 and total assets of $2,500,000, its BEP is:

($500,000 / $2,500,000) * 100 = 20%

This indicates that the company generates 20 cents of EBIT for every dollar of assets it employs.

Interpreting the BEP: Industry Benchmarks and Limitations

While a higher BEP generally indicates better asset utilization, a "good" BEP varies significantly across industries. A capital-intensive manufacturing company might have a lower BEP than a technology company with fewer physical assets. Therefore, comparing your company's BEP to industry averages is essential for meaningful interpretation. Many financial websites and industry reports provide such benchmarks.

Importantly, the BEP is not a standalone metric. It ignores depreciation, working capital changes, and non-operating income. For a comprehensive assessment, combine BEP analysis with other key ratios like Return on Assets (ROA) and Return on Equity (ROE). "The BEP offers valuable insights, but it's crucial to consider the complete financial picture," advises Dr. Anya Sharma, Professor of Finance at the University of California, Berkeley.

Who Uses the BEP and Why?

The BEP is a valuable tool for diverse stakeholders:

- Investors: Quickly assess a company's operational efficiency relative to its peers.

- Management: Track progress over time, identify areas needing improvement, and guide strategic decision-making. A declining BEP might signal the need for operational changes.

- Credit Rating Agencies: Assess a company's creditworthiness, considering its ability to generate profits from its assets.

Strategies to Improve Your Company's BEP

Improving your company's BEP requires a multi-pronged approach:

- Enhance Operational Efficiency: Streamline processes, reduce waste, optimize inventory, and invest in technology to boost productivity and lower costs.

- Strategic Asset Management: Regularly evaluate asset utilization, carefully plan capital expenditures, and ensure assets contribute optimally to profitability.

- Revenue Enhancement: Focus on product innovation, explore new pricing strategies, and consider market expansion to increase sales and profitability.

"Focusing on both cost reduction and revenue growth is crucial for sustainable BEP improvement," notes Mr. David Chen, Chief Financial Officer at Tech Innovators Inc.

A Real-World Example: Comparing Two Companies

Let's consider two companies in the same industry:

- Company A: EBIT of $750,000, Total Assets of $3,000,000; BEP = 25%

- Company B: EBIT of $500,000, Total Assets of $2,000,000; BEP = 25%

While both companies show the same BEP, a closer look at their absolute EBIT and asset levels reveals that Company A is larger and generates more profit, suggesting a potentially more robust financial position. This illustrates the importance of considering additional metrics alongside the BEP.

Conclusion: Leverage the BEP for Enhanced Profitability

The BEP ratio provides a valuable snapshot of a company's operational efficiency. However, its effectiveness is maximized when used in conjunction with other financial metrics and contextual industry analysis. By understanding its calculation, interpretation, and limitations, you can leverage this simple yet powerful tool to enhance your company's profitability and make informed business decisions.